There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

In ICAI’s words, “Laws and rules regulate the relationship between business and profession.” A Chartered Accountant has to work in the professional business world, hence, it is an important requisite for Chartered Accountancy students to have the knowledge of the Laws and Regulations applicable in the business world.

The aim of the subject ‘Corporate and Other Laws’ is to make the students aware of the laws and regulations and equip them with the required knowledge which will help them address the issues in moderately complex scenarios.

For a student, starting their CA Intermediate journey, Law can be a very interesting subject or a primarily difficult subject. It depends on the interest of the students and the approach they apply to study law. But in either case, students have to know about the subject in hand very well.

The subject Law at CA Intermediate Level contains Company Law, The Indian Contract Act, The Negotiable Instruments Act, The General Clauses Act, and Interpretation of statutes.

In this blog, we will talk about the subject Law, the syllabus, sources from which you can study, how to prepare for the exam and a lot more.

The Chartered Accountancy course is divided into three levels and a three-year practical training called Articleship. The three levels of the Chartered Accountancy course includes CA Foundation, CA Intermediate, and CA Final.

Students have to do a compulsory three-year training after clearing their CA Intermediate papers, called Articleship, to be eligible to appear for the CA Final examination.

After clearing the CA Final exam, students get to become a member of the Institute of Chartered Accountants of India, and add the title Chartered Accountant (CA) to their name.

The Intermediate level of Chartered Accountancy course includes two groups, Group I and Group II. Each group consists of four papers. Students need to clear all the papers in order to proceed further in the Chartered Accountancy course.

The Group I of the CA Intermediate course contains four papers. These papers are -

Paper 1: Accounting

Paper 2: Corporate and Other Laws

Paper 3: Cost and Management Accounting, and

Paper 4: Taxation

Each paper consists of 100 marks. A student needs to score a minimum of 40 marks to clear the paper and a minimum of 50% of the total or 200 marks in order to clear each group. Students who score 60 marks or more score exemption.

The second group of Chartered Accountancy Intermediate level also consists of four papers. Like group I, all the papers of group II also consist of 100 marks. A score of 40 marks is required to clear the paper. Following are the subjects of group II -

Paper 5: Advanced Accounting

Paper 6: Auditing and Assurance

Paper 7: Enterprise Information Technology and Strategic Management

Paper 8: Financial Management and Economics for Finance

In this blog, we are going to talk about the Paper 2 of Group I of CA Intermediate - Corporate and Other Laws.

The objective of Corporate and Other Laws paper at the CA Intermediate Level is to develop an understanding of the provisions of company law and acquire the ability to address application oriented issues through the Part one of the paper - Company Law.

The second part of the Paper 2 - Corporate and Other Laws contains The Indian Contract Act, The Negotiable Instruments Act, The General Clauses Act, and the Interpretation of statutes. The main object of the second part is to develop an understanding of the select legislations and acquire the ability to address application oriented issues and to develop an understanding of the rules for the interpretation of statutes.

The first part of Paper 2: Corporate and Other Laws is the Companies Act, 2013. The students only have to study Sections 1 to Sections 148 of the Companies Act, 2013. This includes the following -

The second part of the Paper 2 Corporate and Other Laws include the following -

There are two modules for the paper Corporate and Other Laws. The first module contains The Companies Act, 2013 and the second module contains the other laws portion. The detailed syllabus of the subject is given below.

| CHAPTER 1: PRELIMINARY |

|

| |

| CHAPTER 2: INCORPORATION OF COMPANY AND MATTERS INCIDENTAL THERETO | |

| |

| CHAPTER 3: PROSPECTUS AND ALLOTMENT OF SECURITIES | |

| |

| CHAPTER 4: SHARE CAPITAL AND DEBENTURES | |

| |

| CHAPTER 5: ACCEPTANCE OF DEPOSITS BY COMPANIES | |

| |

| CHAPTER 6: REGISTRATION OF CHARGES | |

| |

| CHAPTER 7: MANAGEMENT & ADMINISTRATION | |

| |

| CHAPTER 8: DECLARATION AND PAYMENT OF DIVIDEND | |

| |

| CHAPTER 9: ACCOUNTS OF COMPANIES | |

| |

| CHAPTER 10: AUDIT AND AUDITORS | |

| |

The second module of Corporate and Other Laws focuses on the Other Laws section. This contains The Indian Contract Act, 1872, The Negotiable Instruments Act, 1881, The General Clauses Act, 1897, and Interpretation of Statutes. The detailed syllabus of the same is given below.

| CHAPTER 1: THE INDIAN CONTRACT ACT, 1872 | |

| UNIT-1: CONTRACT OF INDEMNITY AND GUARANTEE | |

|

|

| UNIT -2: BAILMENT AND PLEDGE | |

| |

| UNIT-3: AGENCY | |

| |

| CHAPTER 2: THE NEGOTIABLE INSTRUMENTS ACT, 1881 | |

| |

| CHAPTER 3: THE GENERAL CLAUSES ACT, 1897 | |

| |

| CHAPTER 4: INTERPRETATION OF STATUTES | |

| |

| Intermediate Course Paper 2: Corporate and Other Laws (100 Marks) Content Area |

||

| Sections |

Weightage | Content Area |

| The Companies Act, 2013- Section 1 to 148 | ||

| I | 25% - 40% | 1. Preliminary 2. Incorporation of company and matters incidental thereto 3. Prospectus and Allotment of securities 4. Share capital and Debentures |

| II | 25% - 35% | 5. Acceptance of Deposits by companies 6. Registration of Charges 7. Management and Administration |

| III | 35% - 40% | 8. Declaration and payment of dividend 9. Accounts of companies 10. Audit and auditors |

| Part II - Other Laws (40 Marks) | ||

| I | 30% - 35% | 1. The Indian Contract Act, 1872 (Specific contracts covered from section 123 onwards): Contract of Indemnity and Guarantee, Bailment, Pledge, Agency |

| II | 20% - 35% | 2. The Negotiable Instruments Act, 1881: Meaning of Negotiable Instruments, Characteristics, Classification of Instruments, Different provisions relating to Negotiation, Negotiability, Assignability, Right and Obligation of parties, presentment of Instruments, Rules of Compensation |

| III | 15% - 25% | 3. The General Clauses Act, 1897: Important Definitions, Extent and Applicability, General Rules of Construction, Powers and Functionaries, Provisions as to Orders, Rules, etc. made under Enactments, Miscellaneous |

| IV | 15% - 25% | 4. Interpretation of statutes: Rules of Interpretation of statutes, Aids to interpretation, Rules of Interpretation/construction of Deeds and Documents |

| Paper |

Intermediate Course | Level I Comprehension & Knowledge | Level II Analysis & Application |

| 2 | Part I: Corporate Laws | 40% - 55% | 45% - 60% |

| Part II: Other Laws | 35% - 55% | 45% - 65% |

| Skill Level |

Description of skills | Nature of Questions | Illustrative verbs |

| Comprehension & Knowledge | Knowledge involves recognizing or remembering facts, terms and basic concepts. Comprehension involves demonstrating understanding of facts. | Questions set at this level require recognition and recall of concepts, principles and provisions. Such questions may involve recalling a definition, explaining a concept, describing a process, discussing a provision of law, listing the conditions to be satisfied or classifying under the appropriate head. | List, State, Define, Describe, Explain, Recognize, Identify, Classify, Discuss |

| Analysis & Application | Application involves use of acquired knowledge in problem-solving. Analysis involves identifying issues and examining the same to resolve problems. | Questions set at this level require applying and analysing concepts/provisions/theories/principles learnt, in problem-solving. Such questions may involve making computations/ calculations/estimations, examining issues, reconciling bank statements, solving problems by integrating provisions, identifying the nature of expenditure or income, determining profit or loss etc. The level of complexity ranges from low to moderate. | Application: Apply, Identify, Prepare, Calculate, Reconcile, Solve Analysis: Analyse, Examine, Compute, Solve, Advise, Determine, Estimate |

The first and foremost question that comes to the mind of a Chartered Accountancy student is, “Why am I being taught Law in CA Course?” And it’s a completely valid question.

Before looking into the reasoning we need to know what the subject ‘Corporate and Other Laws’ is all about.

At the Intermediate level, the subject deals with:

Company Law, as the name suggests, is all about the provisions related to a company. Other Laws however include chapters such as The Indian Contract Act, 1872, The Negotiable Instruments Act, 1881, The General Clauses Act, 1897, Interpretation of Statutes, etc.

Going with the definition provided by the ICAI, we see that Laws generally regulate the relationship between business and profession. A person working in the Accounting Department must have a fair knowledge about the legal provisions. This hugely affects business transactions and one’s ability to apply acquired professional knowledge while solving problems.

In recent times, the traditional role of a Chartered Accountant that used to be restricted to Accounting and Auditing has changed drastically. The qualified Chartered Accountants are now judged more on the basis of skills they possess.

In an organization, while performing day-to-day activities, we see the applicability of legal provisions. Even though we can refer to the Bare Act at any given point, only an expert can instantly connect a provision to the present scenario. Therefore, this subject also enhances the analytical skills of an individual, thereby making it even more important in today’s times.

The Institute of Chartered Accountants of India has included Corporate and Other Laws as Paper 2 in the CA Intermediate course. It is important to study Law in the Chartered Accountancy Course for a number of reasons:

1. Getting in touch with legal provisions -

For a student belonging to the Chartered Accountancy course, it is very vital that they understand the importance of staying updated with the latest legal provisions. Qualified Chartered Accountants step into the corporate world practising a profession for which they invested a large portion of their lives.

Here, even a calculation is made after considering the latest provisions. We can’t find out the correct figure without knowing the latest legal rates. Similarly, Law is important to carry out day-to-day activities.

2. Learning theoretical and practical aspects of the same subject -

Even though Law is evaluated as a theoretical paper, it still holds its position high up as a practical subject. The reason behind law being considered a practical subject is that we get to witness every provision of law that we studied in our day-to-day life. Thus, while studying law, we get the opportunity to study both theoretical as well as the practical aspects of the same subject.

3. Witnessing the applicability of text into real-life scenarios -

As mentioned in the above point, what we study in law, we see in our day-to-day life. For example, someone gives us a few items to look after in their absence. However, they fail to return on time.

One of the items is a perishable good. What do we do now? We refer to the provisions of Indian Contract Act, 1872 which clearly states what a person can or can not do while looking after someone’s perishable goods. So, we see the legal provision practically applying to a basic real-life scenario.

4. Inculcating analytical skills during problem-solving -

In the corporate world, problem solving is not all about Mathematics. We need to be aware of the background upon which that particular problem is based. Many times problems are solved referring to the legal provisions. These legal provisions are created in order to provide a guideline to people whenever they find themselves facing a dilemma.

When students get introduced to Law, they ask whether Law is a theory subject or a practical subject? The whole subject includes texts, laws, and provisions, then why do some people call Law a practical subject? To answer this question we need to first understand what is the difference between a theory subject and a practical subject?

A practical subject is often confused with a subject consisting of numerical. Students think solving a few questions consisting of a balance sheet is what makes a subject practical. On the other hand, if a subject consists of texts, students consider it to be a theory subject.

It does not matter whether a subject consists of mere texts or a lot of numerical questions, anything that you can apply in the practical world is practical. Anything that you have studied and you can apply in the real world is considered practical.

Now coming back to our question, is Law a practical subject? Let’s take an example. Suppose we studied about the ‘time value of money’ and you thought to yourself that you learnt something and it is going to help you in the practical world. Later, after becoming a professional, you decided to open your own company.

Now, in this scenario, you are going to use the knowledge of the Incorporation of a Company while starting your own company. The texts you read as theory are now applicable in the practical world to help you with the incorporation of your company. Hence, that once theory now became a practical application.

The notion of a theory and a practical subject that we are taught from the very beginning is flawed in itself. Just because a subject contains texts doesn’t make it theoretical. If you apply that theory in the real world, it becomes practical. Hence, if you are going to apply the provisions of the law in the professional world, which you will, that makes Law a practical subject.

The Institute of Chartered Accountants of India issues study materials and other resources through which students can prepare for the exam. When students get registered with the Institute of Chartered Accountants of India, they receive all the study materials required for their studies.

These study materials can be found online as well at the Board of Studies’ Knowledge Portal. The latest edition of the materials are available and students can download it as well. Students can also buy the latest materials of the Institute of Chartered Accountants of India online.

The different resources available with the students are as follows -

The Institute of Chartered Accountants of India’s Study Material contains the entire syllabus of the course. The study materials include various modules. For the Paper 2: Corporate and Other Laws there are two modules.

One module contains the Corporate Laws part which is about the Companies Act, 2013. The second module is of Other Laws which includes The Indian Contract Act, 1872, The Negotiable Instruments Act, 1881, The General Clauses Act, 1897, and The Interpretation of Statutes.

The latest version of the Institute of Chartered Accountants of India’s Study Materials contains practice questions at the end of each chapter. With the inclusion of questions in the Study Materials themselves, the Practice Manuals have been discontinued.

Earlier the Study Materials included Multiple Choice Questions as well but with the latest editions of the Study Materials, the Multiple Choice Questions are not included in the book. There is a separate booklet for the Multiple Choice Questions.

The students can download the latest version of the Paper 2: Corporate and Other Laws Study Material by clicking here.

The Practice Manual for the Corporate and Other Laws have been discontinued by the Institute of Chartered Accountants of India. Earlier the Practice Manuals contained the questions for each chapter along with the past year questions and other important questions. With the new editions of Study Materials, the questions are included in the Study Materials themselves and hence the Practice Manuals are no longer required.

But if a student can find the previous practice manuals, they can write down the important questions from them. One thing to keep in mind while using old editions of study materials is that students should keep the amendments applicable to their respective attempts in mind.

The Institute of Chartered Accountants of India has allotted 30 marks for Multiple Choice Questions and Case based scenarios in certain core papers of CA Intermediate. These objective type questions are compulsory and come for 30 marks in the exams. Corporate and Other Laws is one such paper in which the Multiple Choice Questions have been launched.

To help students prepare for the Multiple Choice Questions, the Institute of Chartered Accountants of India has launched Multiple Choice Questions and Case Scenarios booklet. Earlier the Multiple Choice Questions were mentioned in the study materials themselves but with the latest editions, the Multiple Choice Questions are issued separately in a booklet.

Students can view and download the Multiple Choice Questions and Case Scenarios by clicking here.

Revision Test Papers or RTPs are one of the most important resources available to the students. They are issued before each attempt and include the amendments applicable for each attempt along with the important questions for each chapter.

The Revision Test Papers contain questions that have high chances of coming into the examination. Students can easily score 10 to 15 marks by going through the Revision Test Papers thoroughly and practising them well.

Students can download the Revision Test Papers from the below mentioned links -

The Institute of Chartered Accountants of India issues Mock Test Papers before each attempt. These papers are designed in the same manner as the question paper to be asked in the exam. The mock test paper is of 100 marks just like the actual exam.

Mock Test Papers are set up as per the ICAI’s exam pattern. There is the same number of questions as there would be in the actual exam. The time allotted for the Mock Test Paper is 3 hours. Students are required to solve the paper in exactly 3 hours time.

Students have the option to give the Mock Test at the nearest ICAI or Board of Studies centre. These mock tests are set up in the same atmosphere as the actual exam. Alternatively, students can also download the Mock Test Papers from the Institute of Chartered Accountants of India’s website.

Giving mock tests improves the speed of the students before even taking the actual exam. Students get to know what exactly to expect from the exam. Moreover, this gives an idea of where a student stands regarding their preparation.

The Mock Test Papers for the Paper 2: Corporate and Other Laws is divided into two sections called Division A and Division B. Division A is of 30 marks and contains Multiple Choice Questions and Case based scenarios.

There are four questions in this division out of which a student has to attempt any three. The second part of the paper, Division B, contains descriptive questions and is of 70 marks.

Students can access the latest Mock Test Paper and its answer for Paper 2 Corporate and Other Laws by clicking here.

The ICAI also uploads the past term question papers on its website for students to download and practice. Previous year question papers are a great resource for CA students. By solving these papers students get an idea of what to expect in the exam.

There are high chances of questions getting repeated in the exam from the previous year papers. It is highly suggested to students to download these papers and solve them for practice purpose and for finding out the repetitive questions which have high chances of coming in the exams.

Students can download the previous year question papers for Corporate and Other Laws from the direct links mentioned below.

Along with the question papers, the Institute of Chartered Accountants of India also issues Suggested Answers for each paper. These answers are for students to tally their answers and figure out whether their answers were correct or not. These are also a way to check how ICAI expects the questions to be answered.

Students can check out the suggested answers of Corporate and Other Laws for the respective attempts by clicking the direct links below.

Sections form a huge part of CA Intermediate Corporate and Other Laws paper. Mentioning relevant sections in the answers gives a hint of student’s knowledge about the subject matter and forms a good impression on the examiner. Students should try to mention sections wherever possible.

Students should make a list of the sections from the very beginning and try to go through it every day to help them remember these sections. We have mentioned all the sections from all the chapters at one place below. Students can note it down for their use.

CHAPTER I: PRELIMINARY

| SECTION NUMBER | SECTION NAME |

| 1 | Short title, extent, commencement and application |

| 2 | Definitions |

CHAPTER II: INCORPORATION OF COMPANY AND MATTERS INCIDENTAL THERETO

| SECTION NUMBER | SECTION NAME |

| 3 | Formation of Company |

| 4 | Memorandum |

| 5 | Articles |

| 6 | Act to Override Memorandum, Articles, etc |

| 7 | Incorporation of Company |

| 8 | Formation of Company with Charitable Objects etc. |

| 9 | Effect of Registration |

| 10 | Effect of Memorandum and Articles |

| 11 | Commencement of Business, etc. |

| 12 | Registered Office of Company |

| 13 | Alteration of Memorandum |

| 14 | Alteration of Articles |

| 15 | Alteration of Memorandum or Articles to be Noted in every copy |

| 16 | Rectification of Name of Company |

| 17 | Copies of Memorandum, Articles, etc. to be given to Members |

| 18 | Conversion of Companies already Registered |

| 19 | Subsidiary Company not to hold shares in its Holding Company |

| 20 | Service of Documents |

| 21 | Authentication of Documents, Proceedings and Contracts |

| 22 | Execution of Bill of Exchange, etc. |

CHAPTER III: PROSPECTUS AND ALLOTMENT OF SECURITIES

| SECTION NUMBER |

SECTION NAME |

| 23 | Public offer and private placement |

| 24 | Power of Securities and Exchange Board to regulate issue and transfer of securities, etc. |

| 25 | Document containing offer of securities for sale to be deemed prospectus |

| 26 | Matters to be stated in prospectus |

| 27 | Variation in terms of contract or objects in prospectus |

| 28 | Offer of sale of shares by certain members of company |

| 29 | Public offer of securities to be in dematerialised form |

| 30 | Advertisement of prospectus |

| 31 | Shelf prospectus |

| 32 | Red herring prospectus |

| 33 | Issue of application forms for securities |

| 34 | Criminal liability for misstatements in prospectus |

| 35 | Civil liability for misstatements in prospectus |

| 36 | Punishment for fraudulently inducing persons to invest money |

| 37 | Action by affected persons |

| 38 | Punishment for personation for acquisition, etc., of securities |

| 39 | Allotment of securities by company |

| 40 | Securities to be dealt with in stock exchanges |

| 41 | Global depository receipt |

| 42 | Offer or invitation for subscription of securities on private placement |

CHAPTER IV: SHARE CAPITAL AND DEBENTURES

| SECTION NUMBER |

SECTION NAME |

| 43 | Kinds of share capital |

| 44 | Nature of shares or debentures |

| 45 | Numbering of shares |

| 46 | Certificate of shares |

| 47 | Voting rights |

| 48 | Variation of shareholders’ rights |

| 49 | Calls on shares of same class to be made on uniform basis |

| 50 | Company to accept unpaid share capital, although not called up |

| 51 | Payment of dividend in proportion to amount paid-up |

| 52 | Application of premiums received on issue of shares |

| 53 | Prohibition on issue of shares at discount |

| 54 | Issue of sweat equity shares |

| 55 | Issue and redemption of preference shares |

| 56 | Transfer and transmission of securities |

| 57 | Punishment for personation of shareholder |

| 58 | Refusal of registration and appeal against refusal |

| 59 | Rectification of register of members |

| 60 | Publication of authorised, subscribed and paid-up capital |

| 61 | Power of limited company to alter its share capital |

| 62 | Further issue of share capital |

| 63 | Issue of bonus shares |

| 64 | Notice to be given to Registrar for alteration of share capital |

| 65 | Unlimited company to provide for reserve share capital on conversion into limited company |

| 66 | Reduction of share capital |

| 67 | Restrictions on purchase by company or giving of loans by it for purchase of its shares |

| 68 | Power of company to purchase its own securities |

| 69 | Transfer of certain sums to capital redemption reserve account |

| 70 | Prohibition for buy-back in certain circumstances |

| 71 | Debentures |

| 72 | Power to nominate |

CHAPTER V: ACCEPTANCE OF DEPOSITS BY COMPANIES

| SECTION NUMBER |

SECTION NAME |

| 73 | Prohibition on acceptance of deposits from public |

| 74 | Repayment of deposits, etc., accepted before commencement of this Act |

| 75 | Damages for fraud |

| 76 | Acceptance of deposits from public by certain companies |

| 76A | Punishment for contravention of section 73 or section 76 |

CHAPTER VI: REGISTRATION OF CHARGES

| SECTION NUMBER |

SECTION NAME |

| 77 | Duty to register charges, etc. |

| 78 | Application for registration of charge |

| 79 | Section 77 to apply in certain matters |

| 80 | Date of notice of charge |

| 81 | Register of charges to be kept by Registrar |

| 82 | Company to report satisfaction of charge |

| 83 | Power of Registrar to make entries of satisfaction and release in absence of intimation from company |

| 84 | Intimation of appointment of receiver or manager |

| 85 | Company’s register of charges |

| 86 | Punishment for contravention |

| 87 | Rectification by Central Government in register of charges |

CHAPTER VII: MANAGEMENT AND ADMINISTRATION

| SECTION NUMBER |

SECTION NAME |

| 88 | Register of members, etc. |

| 89 | Declaration in respect of beneficial interest in any share |

| 90 | Investigation of beneficial ownership of shares in certain cases |

| 91 | Power to close register of members or debenture holders or other security holders |

| 92 | Annual return |

| 93 | Return to be filed with Registrar in case promoters’ stake changes |

| 94 | Place of keeping and inspection of registers, returns, etc. |

| 95 | Registers, etc., to be evidence |

| 96 | Annual general meeting |

| 97 | Power of Tribunal to call annual general meeting |

| 98 | Power of Tribunal to call meetings of members, etc. |

| 99 | Punishment for default in complying with provisions of sections 96 to 98 |

| 100 | Calling of extraordinary general meeting |

| 101 | Notice of meeting |

| 102 | Statement to be annexed to notice |

| 103 | Quorum for meetings |

| 104 | Chairman of meetings |

| 105 | Proxies |

| 106 | Restriction on voting rights |

| 107 | Voting by show of hands |

| 108 | Voting through electronic means |

| 109 | Demand for poll |

| 110 | Postal ballot |

| 111 | Circulation of members’ resolution |

| 112 | Representation of President and Governors in meetings |

| 113 | Representation of corporations at meeting of companies and of creditors |

| 114 | Ordinary and special resolutions |

| 115 | Resolutions requiring special notice |

| 116 | Resolutions passed at adjourned meeting |

| 117 | Resolutions and agreements to be filed |

| 118 | Minutes of proceedings of general meeting, meeting of Board of Directors and other meeting and resolutions passed by postal ballot |

| 119 | Inspection of minute-books of general meeting |

| 120 | Maintenance and inspection of documents in electronic form |

| 121 | Report on annual general meeting |

| 122 | Applicability of this Chapter to One Person Company |

CHAPTER VIII: DECLARATION AND PAYMENT OF DIVIDEND

| SECTION NUMBER |

SECTION NAME |

| 123 | Declaration of dividend |

| 124 | Unpaid Dividend Account |

| 125 | Investor Education and Protection Fund |

| 126 | Right to dividend, rights shares and bonus shares to be held in abeyance pending registration of transfer of shares |

| 127 | Punishment for failure to distribute dividends |

CHAPTER IX: ACCOUNTS OF COMPANIES

| SECTION NUMBER |

SECTION NAME |

| 128 | Books of account, etc., to be kept by company |

| 129 | Financial statement |

| 130 | Re-opening of accounts on court’s or Tribunal’s orders |

| 131 | Voluntary revision of financial statements or Board’s report |

| 132 | Constitution of National Financial Reporting Authority |

| 133 | Central Government to prescribe accounting standards |

| 134 | Financial statement, Board’s report, etc. |

| 135 | Corporate Social Responsibility |

| 136 | Right of member to copies of audited financial statement |

| 137 | Copy of financial statement to be filed with Registrar |

| 138 | Internal audit |

CHAPTER X: AUDIT AND AUDITORS

| SECTION NUMBER |

SECTION NAME |

| 139 | Appointment of auditors |

| 140 | Removal, resignation of auditor and giving of special notice |

| 141 | Eligibility, qualifications and disqualifications of auditors |

| 142 | Remuneration of auditors |

| 143 | Powers and duties of auditors and auditing standards |

| 144 | Auditor not to render certain services |

| 145 | Auditor to sign audit reports, etc. |

| 146 | Auditors to attend general meeting |

| 147 | Punishment for contravention |

| 148 | Central Government to specify audit of items of cost in respect of certain companies |

PRELIMINARY

| SECTION NUMBER |

SECTION NAME |

| 1 | Short title |

| 2 | Interpretation-clause |

CHAPTER I: Communication, Acceptance and Revocation of Proposals

| SECTION NUMBER |

SECTION NAME |

| 3 | Communication, acceptance and revocation of proposals |

| 4 | Communication when complete |

| 5 | Revocation of proposals and acceptances |

| 6 | Revocation how made |

| 7 | Acceptance must be absolute |

| 8 | Acceptance by performing conditions, or receiving consideration |

| 9 | Promises, express and implied |

CHAPTER II: Contracts, Voidable Contracts, and Void Agreements

| SECTION NUMBER |

SECTION NAME |

| 10 | What agreements are contracts |

| 11 | Who are competent to contract |

| 12 | What is a sound mind for the purposes of contracting |

| 13 | Consent defined |

| 14 | "Free consent" defined |

| 15 | "Coercion" defined |

| 16 | "Undue influence" defined |

| 17 | "Fraud" defined |

| 18 | "Misrepresentation" defined |

| 19 | Voidability of agreements without free consent |

| 19A | Power to set aside contract induced by undue influence |

| 20 | Agreement void where both parties are under mistake as to matter of fact |

| 21 | Effect of mistakes as to law |

| 22 | Contract caused by mistake of one party as to matter of fact |

| 23 | What consideration and objects are lawful, and what not |

| 24 | Agreements void, if considerations and objects unlawful in part |

| 25 | Agreement without consideration, void, unless it is in writing and registered or is a promise to compensate for something done or is a promise to pay a debt barred by limitation law |

| 26 | Agreement in restraint of marriage, void |

| 27 | Agreement in restraint of trade, void |

| 28 | Agreements in restraint of legal proceedings, void |

| 29 | Agreements void for uncertainty |

| 30 | Agreements by way of wager, void |

CHAPTER III: Contingent Contracts

| SECTION NUMBER |

SECTION NAME |

| 31 | "Contingent contract" defined |

| 32 | Enforcement of contracts contingent on an event happening |

| 33 | Enforcement of contract contingent on an event not happening |

| 34 | When event on which contract is contingent to be deemed impossible, if it is the future conduct of a living person |

| 35 | When contracts become void, which are contingent on happening of specified event within fixed time |

| 36 | Agreements contingent on impossible events, void |

CHAPTER IV: Performance of Contracts which must be Performed

| SECTION NUMBER |

SECTION NAME |

| 37 | Obligations of parties to contracts |

| 38 | Effect of refusal to accept offer of performance |

| 39 | Effect of refusal of party to perform promise wholly |

| 40 | Person by whom promise is to be performed |

| 41 | Effect of accepting performance from third person |

| 42 | Devolution of joint liabilities |

| 43 | Any one of joint promisors may be compelled to perform |

| 44 | Effect of release of one joint promisor |

| 45 | Devolution of joint rights |

46 | Time for performance of promise, where no application is to be made and no time is specified |

| 47 | Time and place for performance of promise, where time is specified and no application to be made |

| 48 | Application for performance on certain day to be at proper time and place |

| 49 | Place for the performance of promise, where no application to be made and no place fixed for performance |

| 50 | Performance, in manner or at time prescribed or sanctioned by promisee |

| 51 | Promisor not bound to perform, unless reciprocal promisee ready and willing to perform |

| 52 | Order of performance of reciprocal promises |

| 53 | Liability of party preventing event on which contract is to take effect |

| 54 | Effect of default as to the promise which should be performed, in contract consisting of reciprocal promises |

| 55 | Effect of failure to perform at fixed time, in contract in which time is essential |

| 56 | Agreement to do impossible act |

| 57 | Reciprocal promise to do things legal, and also other things illegal |

| 58 | Alternative promise, one branch being illegal |

| 59 | Application of payment where debt to be discharged is indicated |

| 60 | Application of payment where debt to be discharged is not indicated |

| 61 | Application of payment where neither party appropriates |

| 62 | Effect of novation, rescission, and alteration of contract |

| 63 | Promise may dispense with or remit performance of promise |

| 64 | Consequence of rescission of a voidable contract |

| 65 | Obligation of person who has received advantage under void agreement, or contract that becomes void |

| 66 | Mode of communicating or revoking rescission of voidable contract |

| 67 | Effect of neglect of promisee to afford promisor reasonable facilities for performance |

CHAPTER V: Certain Relations Resembling those created by Contract

| SECTION NUMBER |

SECTION NAME |

| 68 | Claim for necessaries supplied to person incapable of contracting, or on his account |

| 69 | Reimbursement of person paying money due by another, in payment of which he is interested |

| 70 | Obligation of person enjoying benefit of non-gratuitous act |

| 71 | Responsibility of finder of goods |

| 72 | Liability of person to whom money is paid, or thing delivered, by mistake or under coercion |

CHAPTER VI: The Consequences of Breach of Contract

| SECTION NUMBER |

SECTION NAME |

| 73 | Compensation of loss or damage caused by breach of contract |

| 74 | Compensation for breach of contract where penalty stipulated for |

| 75 | Party rightfully rescinding contract, entitled to compensation |

CHAPTER VIII: Indemnity and Guarantee

| SECTION NUMBER |

SECTION NAME |

| 124 | "Contract of indemnity" defined |

| 125 | Right of indemnity-holder when sued |

| 126 | "Contract of guarantee", "surety", "principal debtor" and "creditor" |

| 127 | Consideration for guarantee |

| 128 | Surety's liability |

| 129 | Continuing guarantee |

| 130 | Revocation of continuing guarantee |

| 131 | Revocation of continuing guarantee by surety's death |

| 132 | Liability of two persons, primarily liable, not affected by arrangement between them that one shall be surety on other's default |

| 133 | Discharge of surety by variance in terms of contract |

| 134 | Discharge of surety by release or discharge of principal debtor |

| 135 | Discharge of surety when creditor compounds with, gives time to, or agrees not to sue, principal debtor |

| 136 | Surety not discharged when agreement made with third person to give time to principal debtor |

| 137 | Creditor's forbearance to sue does not discharge surety |

| 138 | Release of one co-surety does not discharge others |

| 139 | Discharge of surety by creditor's act or omission impairing surety's eventual remedy |

| 140 | Rights of surety on payment or performance |

| 141 | Surety's right to benefit of creditor's securities |

| 142 | Guarantee obtained by misrepresentation, invalid |

| 143 | Guarantee obtained by concealment, invalid |

| 144 | Guarantee on contract that creditor shall not act on it until co-surety joins |

| 145 | Implied promise to indemnify surety |

| 146 | Co-sureties liable to contribute equally |

| 147 | Liability of co-sureties bound in different sums |

CHAPTER IX: Bailment

| SECTION NUMBER | SECTION NAME |

| 148 | "Bailment", "bailor" and "bailee" defined |

| 149 | Delivery to bailee how made |

| 150 | Bailor's duty to disclose faults in goods bailed |

| 151 | Care to be taken by bailee |

| 152 | Bailee when not liable for loss, etc, of thing bailed |

| 153 | Termination of bailment by bailee's act inconsistent with conditions |

| 154 | Liability of bailee making unauthorized use of goods bailed |

| 155 | Effect of mixture with bailor's consent, of his goods with bailee's |

| 156 | Effect of mixture, without bailor's consent, when the goods can be separated |

| 157 | Effect of mixture, without bailor's consent, when the goods cannot be separated |

| 158 | Repayment, by bailor, of necessary expenses |

| 159 | Restoration of goods lent gratuitously |

| 160 | Return of goods bailed, on expiration of time or accomplishment of purpose |

| 161 | Bailee's responsibility when goods are not duly returned |

| 162 | Termination of gratuitous bailment by death |

| 163 | Bailer entitled to increase or profit from goods bailed |

| 164 | Bailor's responsibility to bailee |

| 165 | Bailment by several joint owners |

| 166 | Bailee not responsible on redelivery to bailor without title |

| 167 | Right of third person claiming goods bailed |

| 168 | Right of finder of goods may sue for specified reward offered |

| 169 | When finder of thing commonly on sale may sell it |

| 170 | Bailee's particular lien |

| 171 | General lien of bankers, factors, wharfingers, attorneys and policy brokers |

| 172 | "Pledge", "pawnor", and "pawnee" defined |

| 173 | Pawnee's right of retainer |

| 174 | Pawnee not to retain for debt or promise other than that for which goods pledged-Presumption in case of subsequent advances |

| 175 | Pawnee's right as to extraordinary expenses incurred |

| 176 | Pawnee's right where pawnor makes default |

| 177 | Defaulting pawnor's right to redeem |

| 178 | Pledge by mercantile agent |

| 178A | Pledge by person in possession under voidable contract |

| 179 | Pledge where pawnor has only a limited interest |

| 180 | Suit by bailor or bailee against wrong-doer |

| 181 | Appointment of relief or compensation obtained by such suits |

CHAPTER X: Agency Appointment and Authority of agents

| SECTION NUMBER |

SECTION NAME |

| 182 | "Agent" and "principal" defined or to represent another |

| 183 | Who may employ agent |

| 184 | Who may be an agent |

| 185 | Consideration not necessary |

| 186 | Agent's authority may be express or implied |

| 187 | Definitions of express and implied authority |

| 188 | Extent of agent's authority |

| 189 | Agent's authority in an emergency |

| 190 | When agent cannot delegate |

| 191 | "Sub-agent" defined |

| 192 | Representation of principal by sub-agent properly appointed |

| 193 | Agent's responsibility for sub-agent appointed without authority |

| 194 | Relation between principal and person duly appointed by agent to act in business of agency |

| 195 | Agent's duty in naming such person |

| 196 | Right of person as to acts done for him without his authority-effect of ratification |

| 197 | Ratification may be expressed or implied |

| 198 | Knowledge requisite for valid ratification |

| 199 | Effect of ratifying unauthorized act forming part of a transaction |

| 200 | Ratification of unauthorized act cannot injure third person |

| 201 | Termination of agency |

| 202 | Termination of agency, where agent has an interest in subject-matter |

| 203 | When principal may revoke agent's authority |

| 204 | Revocation where authority has been partly exercised |

| 205 | Compensation for revocation by principal, or renunciation by agent |

| 206 | Notice of revocation or renunciation |

| 207 | Revocation and renunciation may be expressed or implied |

| 208 | When termination of agent's authority takes effect as to agent, and as to third persons |

| 209 | Agent's duty on termination of agency by principal's death or insanity |

| 210 | Termination of sub-agent's authority |

| 211 | Agent's duty in conducting principal's business |

| 212 | Skill and diligence required from agent |

| 213 | Agent's accounts |

| 214 | Agent's, duty to communicate with principal |

| 215 | Right of principal when agent deals, on his own account, in business of agency without principal's consent |

| 216 | Principal's right to benefit gained by agent dealing on his own account in business of agency |

| 217 | Agent's right of retainer out of sums received on principal's account |

| 218 | Agent's duty to pay sums received for principal |

| 219 | When agent's remuneration becomes due |

| 220 | Agent not entitled to remuneration for business misconducted |

| 221 | Agent's lien on principal's property |

| 222 | Agent to be indemnified against consequences of lawful acts |

| 223 | Agent to be indemnified against consequences of acts done in good faith |

| 224 | Non-liability of employer of agent to do a criminal act |

| 225 | Compensation to agent for injury caused by principal's neglect |

| 226 | Enforcement and consequences of agent's contract |

| 227 | Principal how far bound, when agent exceeds authority |

| 228 | Principal not bound when excess of agent's authority is not separable |

| 229 | Consequences of notice given to agent |

| 230 | Agent cannot personally enforce, nor be bound by, contracts on behalf of principal |

| 231 | Right of parties to a contract made by agent not disclosed |

| 232 | Performance of contract with agent supposed to be principal |

| 233 | Right of person dealing with agent personally liable |

| 234 | Consequence of inducing agent or principal to act on belief that principal or agent will be held exclusively liable |

| 235 | Liability of pretended agent |

| 236 | Person falsely contracting as agent, not entitled to performance |

| 237 | Liability of principal inducing belief that agent's unauthorized acts were authorized |

| 238 | Effect, on agreement, of misrepresentation or fraud by agent |

CHAPTER I: PRELIMINARY

| SECTION NUMBER |

SECTION NAME |

| 1 | Short title |

| 2 | Repealed |

| 3 | Interpretation clause |

CHAPTER II: NOTES, BILLS, AND CHEQUES

| SECTION NUMBER |

SECTION NAME |

| 4 | “Promissory Note” |

| 5 | “Bill of Exchange” |

| 6 | “Cheque” |

| 7 | “Drawer” “Drawee” “Drawee in case of need” “Acceptor” “Acceptor for honour” “Payee” |

| 8 | “Holder” |

| 9 | “Holder in due course” |

| 10 | “Payment in due course” |

| 11 | Inland Instrument |

| 12 | Foreign Instrument |

| 13 | “Negotiable Instrument” |

| 14 | Negotiation |

| 15 | Indorsement |

| 16 | Indorsement “in blank” and “in full” “Indorsee |

| 17 | Ambiguous instruments |

| 18 | Where amount is stated differently in figures and words |

| 19 | Instruments payable on demand |

| 20 | Inchoate stamped instruments |

| 21 | “At sight” “On presentment” “After sight” |

| 22 | Maturity Days of grace |

| 23 | Calculating maturity of bill or note payable so many months after date or sight |

| 24 | Calculating maturity of bill or note payable so many days after date or sight |

| 25 | When day of maturity is a holiday |

CHAPTER III: PARTIES TO NOTES, BILLS AND CHEQUES

| SECTION NUMBER |

SECTION NAME |

| 26 | Capacity to make, etc., promissory notes, etc. Minor. |

| 27 | Agency |

| 28 | Liability of agent signing |

| 29 | Liability of legal representative signing |

| 30 | Liability of drawer |

| 31 | Liability of drawee of cheque |

| 32 | Liability of maker of note and acceptor of bill |

| 33 | Only drawee can be acceptor except in need or for honour |

| 34 | Acceptance by several drawees not partners |

| 35 | Liability of indorser |

| 36 | Liability of prior parties to holder in due course |

| 37 | Maker, drawer and acceptor principals |

| 38 | Prior party a principal in respect of each subsequent party |

| 39 | Suretyship |

| 40 | Discharge of indorser’s liability |

| 41 | Acceptor bound, although, indorsement forged |

| 42 | Acceptance of bill drawn in fictitious name |

| 43 | Negotiable instrument made, etc., without consideration |

| 44 | Partial absence or failure of money-consideration |

| 45 | Partial failure of consideration not consisting of money |

| 45A | Holder's right to duplicate of lost bill |

CHAPTER IV: OF NEGOTIATION

| SECTION NUMBER |

SECTION NAME |

| 46 | Delivery |

| 47 | Negotiation by delivery |

| 48 | Negotiation by indorsement |

| 49 | Conversion of indorsement in blank into indorsement in full |

| 50 | Effect of indorsement |

| 51 | Who may negotiate |

| 52 | Indorser who excludes his own liability or makes it conditional |

| 53 | Holder deriving title from holder in due course |

| 54 | Instrument indorsed in blank |

| 55 | Conversion of indorsement in blank into indorsement in full |

| 56 | Indorsement for part of sum due |

| 57 | Legal representative cannot by delivery only negotiate instrument indorsed by deceased |

| 58 | Instrument obtained by unlawful means or for unlawful consideration |

| 59 | Instrument acquired after dishonour or when overdue |

| Accommodation note or bill. | |

| 60 | Instrument negotiable till payment or satisfaction |

CHAPTER V: OF PRESENTMENT

| SECTION NUMBER |

SECTION NAME |

| 61 | Presentment for acceptance |

| 62 | Presentment of promissory note for sight |

| 63 | Drawee’s time for deliberation |

| 64 | Presentment for payment |

| 65 | Hours for presentment |

| 66 | Presentment for payment of instrument payable after date or sight |

| 67 | Presentment for payment of promissory note payable by instalments |

| 68 | Presentment for payment of instrument payable at specified place and not elsewhere. |

| 69 | Instrument payable at specified place |

| 70 | Presentment where no exclusive place specified |

| 71 | Presentment when maker, etc., has no known place of business or residence |

| 72 | Presentment of cheque to charge drawer |

| 73 | Presentment of cheque to charge any other person |

| 74 | Presentment of instrument payable on demand |

| 75 | Presentment by or to agent, representative of deceased, or assignee of insolvent |

| 75A | Excuse for delay in presentment for acceptance or payment |

| 76 | When presentment unnecessary |

| 77 | Liability of banker for negligently dealing with bill presented for payment |

CHAPTER VI: OF PAYMENT AND INTEREST

| SECTION NUMBER |

SECTION NAME |

| 78 | To whom payment should be made |

| 79 | Interest when rate specified |

| 80 | Interest when no rate specified |

| 81 | Delivery of instrument on payment, or indemnity in case of loss |

CHAPTER VII: OF DISCHARGE FROM LIABILITY ON NOTES, BILLS AND CHEQUES

| SECTION NUMBER |

SECTION NAME |

| 82 | Discharge from liability. (a) by cancellation; (b) by release; (c) by payment |

| 83 | Discharge by allowing drawee more than forty-eight hours to accept |

| 84 | When cheque not duly presented and drawer damaged thereby |

| 85 | Cheque payable to order |

| 85A | Drafts drawn by one branch of a bank on another payable to order |

| 86 | Parties not consenting discharged by qualified or limited acceptance |

| 87 | Effect of material alteration. Alteration by indorsee |

| 88 | Acceptor or indorser bound notwithstanding previous alteration |

| 89 | Payment of instrument on which alteration is not apparent |

| 90 | Extinguishment of rights of action on bill in acceptor's hands |

CHAPTER VIII: OF NOTICE OF DISHONOUR

| SECTION NUMBER |

SECTION NAME |

| 91 | Dishonour by non-acceptance |

| 92 | Dishonour by non-payment |

| 93 | By and to whom notice should be given |

| 94 | Mode in which notice may be given |

| 95 | Party receiving must transmit notice of dishonour |

| 96 | Agent for presentment |

| 97 | When party to whom notice given is dead |

| 98 | When notice of dishonour is unnecessary |

CHAPTER IX: OF NOTING AND PROTEST

| SECTION NUMBER |

SECTION NAME |

| 99 | Noting |

| 100 | Protest |

| 101 | Protest for better security |

| 102 | Contents of protest |

| 102 | Notice of protest |

| 103 | Protest for non-payment after dishonour by non-acceptance |

| 104 | Protest of foreign bills |

| 104A | When noting equivalent to protest |

CHAPTER X: OF REASONABLE TIME

| SECTION NUMBER |

SECTION NAME |

| 105 | Reasonable time |

| 106 | Reasonable time of giving notice of dishonour |

| 107 | Reasonable time for transmitting such notice |

CHAPTER XI: OF ACCEPTANCE AND PAYMENT FOR HONOUR AND REFERENCE IN CASE OF NEED

| SECTION NUMBER |

SECTION NAME |

| 108 | Acceptance for honour |

| 109 | How acceptance for honour must be made |

| 110 | Acceptance not specifying for whose honour it is made |

| 111 | Liability of acceptor for honour |

| 112 | When acceptor for honour may be charged |

| 113 | Payment for honour |

| 114 | Right of payer for honour |

| 115 | Drawee in case of need |

| 116 | Acceptance and payment without protest |

CHAPTER XII: OF COMPENSATION

| SECTION NUMBER |

SECTION NAME |

| 117 | Rules as to compensation |

CHAPTER XIII: SPECIAL RULES OF EVIDENCE

| SECTION NAME |

SECTION NUMBER |

| 118 | Presumptions as to negotiable instruments. (a) of consideration; (b) as to date; (c) as to time of acceptance; (d) as to time of transfer; (e) as to order of indorsements; (f) as to stamp; (g) that holder is a holder in due course |

| 119 | Presumption on proof of protest |

| 120 | Estoppel against denying original validity of instrument |

| 121 | Estoppel against denying capacity of payee to indorse |

| 122 | Estoppel against denying signature or capacity of prior party |

CHAPTER XIV: OF CROSSED CHEQUES

| SECTION NUMBER |

SECTION NAME |

| 123 | Cheque crossed generally |

| 124 | Cheque crossed specially |

| 125 | Crossing after issue |

| 126 | Payment of cheque crossed generally. Payment of cheque crossed specially |

| 127 | Payment of cheque crossed specially more than once |

| 128 | Payment in due course of crossed cheque |

| 129 | Payment of crossed cheque out of due course |

| 130 | Cheque bearing “not negotiable” |

| 131 | Non-liability of banker receiving payment of cheque |

| 131A | Application of Chapter to drafts |

CHAPTER XV: OF BILLS IN SETS

| SECTION NAME |

SECTION NUMBER |

| 132 | Set of bills |

| 133 | Holder of first acquired part entitled to |

CHAPTER XVI: OF INTERNATIONAL LAW

| SECTION NUMBER |

SECTION NAME |

| 134 | Law governing liability of maker, acceptor or indorser of foreign instrument |

| 135 | Law of place of payment governs dishonour |

| 136 | Instrument made, etc., out of India, but in accordance with the law of India |

| 137 | Presumption as to foreign law |

CHAPTER XVII: OF PENALTIES IN CASE OF DISHONOUR OF CERTAIN CHEQUES FOR INSUFFICIENCY OF FUNDS IN THE ACCOUNTS

| SECTION NUMBER |

SECTION NAME |

| 138 | Dishonour of cheque for insufficiency, etc., of funds in the account |

| 139 | Presumption in favour of holder |

| 140 | Defence which may not be allowed in any prosecution under section 138 |

| 141 | Offences by companies |

| 142 | Cognizance of offences |

| 142A | Validation for transfer of pending cases |

| 143 | Power of Court to try cases summarily |

| 144 | Mode of service of summons |

| 145 | Evidence on affidavit |

| 146 | Bank’s slip prima facie evidence of certain facts |

| 147 | Offences to be compoundable |

CHAPTER I: PRELIMINARY

| SECTION NUMBER |

SECTION NAME |

| 1 | Short title |

| 2 | [Repealed] |

CHAPTER II: GENERAL DEFINITIONS

| SECTION NUMBER |

SECTION NAME |

| 3 | Definitions |

| 4 | Application of foregoing definitions to previous enactments |

| 4A | Application of certain definitions to Indian Laws |

CHAPTER III: GENERAL RULES OF CONSTRUCTION

| SECTION NUMBER |

SECTION NAME |

| 5 | Coming into operation of enactments |

| 5A | [Repealed.] |

| 6 | Effect of repeal |

| 6A | Repeal of Act making textual amendment in Act or Regulation |

| 7 | Revival of repealed enactments |

| 8 | Construction of references to repealed enactments |

| 9 | Commencement and termination of time |

| 10 | Computation of time |

| 11 | Measurement of distances |

| 12 | Duty to be taken pro rata in enactments |

| 13 | Gender and number |

| 13A | [Repealed.] |

CHAPTER IV: POWERS AND FUNCTIONARIES

| SECTION NUMBER |

SECTION NAME |

| 14 | Powers conferred to be exercisable from time to time |

| 15 | Power to appoint to include power to appoint ex officio |

| 16 | Power to appoint to include power to suspend or dismiss |

| 17 | Substitution of functionaries |

| 18 | Successors |

| 19 | Official chiefs and subordinates |

CHAPTER V: PROVISIONS AS TO ORDERS, RULES, ETC., MADE UNDER ENACTMENTS

| SECTION NUMBER |

SECTION NAME |

| 20 | Construction of orders, etc., issued under enactments |

| 21 | Power to issue, to include power to add to, amend, vary or rescind notifications, orders, rules or bye-laws |

| 22 | Making of rules or bye-laws and issuing of orders between passing and commencement of enactment |

| 23 | Provisions applicable to making of rules or bye-laws after previous publication |

| 24 | Continuation of orders, etc., issued under enactments repealed and re-enacted |

CHAPTER VI: MISCELLANEOUS

| SECTION NUMBER |

SECTION NAME |

| 25 | Recovery of fines |

| 26 | Provision as to offences punishable under two or more enactments |

| 27 | Meaning of service by post |

| 28 | Citation of enactments |

| 29 | Saving for previous enactments, rules and bye-laws |

| 30 | [Repealed.] |

| 31 | [Repealed.] |

It could be hard for students to remember all the sections from each chapter. For this reason we have mentioned some of the important sections below. Students should pay high attention to these sections and try to mention them in the relevant answers in the exam.

| SECTION NUMBER |

SECTION NAMES |

| 2 (42) | Definition of Foreign Company |

| 2 (43) | Definition of Free Reserve |

| 2 (62) |

Definition of One Person Company |

| 2 (68) | Definition of Private Company |

| 2 (71) | Definition of Public Company |

| 2 (85) | Definition of Small Company |

| 11 | Commencement of Business |

| 12 | Registered Office of the Company |

| 21 | Authentication of Documents, Proceedings, and Contract |

| 23 and 42 | Private Placement |

| 28 | Offer for Sale |

| 41 | Issue of Global Depository Receipts |

| 70 | Prohibition on Buy-back of Shares |

| 102 | Explanatory Statement for special business |

| 103 | Quorum for shareholders meeting |

| 104 | Chairman of a general meeting |

| 128 | Books of account, etc., to be kept by company |

| 133 | Central Government to prescribe accounting standards |

| 134 | Financial statement, Board’s report, etc. |

| 135 | Corporate Social Responsibility |

| 138 | Internal Audit |

The Institute of Chartered Accountants of India issues amendments before every attempt. These amendments are in lieu of announcements made during the period of 1st May to 30th April of every year. Students need to keep themselves updated with the amendments in order to prepare for the exams. These amendments are very important from the exam point of view and questions related to the amendments should be given utmost importance as they have high chances of coming in the examination.

The amendments in Corporate and Other Laws till 30th April, 2020 is mentioned below. Students can find this amendment and other important questions by clicking here.

THE COMPANIES ACT, 2013

I. Chapter 2: Incorporation of Company and Matters Incidental thereto

Amendments related to - Notification G.S.R. 357(E) dated 10th May, 2019

The Central Government has amended the Companies (Incorporation) Rules, 2014, by the Companies (Incorporation) Fifth Amendment Rules, 2019.

In the Companies (Incorporation) Rules, 2014, Rule 8 has been fully substituted by Rule 8, Rule 8A and Rule 8B.

[Note: On page 2.19 of the Study Material, under the heading of Undesirable names, ‘the words and combinations thereof which shall not be used in the name of a company depicting the same meaning unless the previous approval of the Central Government has been obtained for the use of any such word or expression’, were earlier covered under Rule 8. As per the amendment now they are dealt in with Rule 8B.]

II. Chapter 3: Prospectus and Allotment of Securities

Amendments related to - Companies (Amendment) Act, 2019

Following sections of the Companies Act, 2013 have been amended by the Companies (Amendment) Act, 2019 through Notification No. S.O. 2947(E) dated 14th August, 2019 [the sections contained therein shall deemed to have come into force on 15th August, 2019]

1. In section 26-

[Amendment to be incorporated on Pg. 3.7 and 3.8 of SM]

2. In section 29-

“(1A) In case of such class or classes of unlisted companies as may be prescribed, the securities shall be held or transferred only in dematerialised form in the manner laid down in the Depositories Act, 1996 and the regulations made thereunder.”

[Amendment to be incorporated on Pg. 3.9 of SM]

3. In section 35, in sub-section (2), in clause (c), for the words “delivery of a copy of the prospectus for registration”, the words “filing of a copy of the prospectus with the Registrar” shall be substituted.

[Amendment to be incorporated on Pg. 3.23 of SM]

III. Chapter 4: Share Capital and Debentures

Amendments related to - Notification G.S.R. 574(E) dated 16th August, 2019

The Central Government has amended the Companies (Share Capital and Debentures) Rules, 2014, by the Companies (Share Capital and Debentures) Amendment Rules, 2019.

In the Companies (Share Capital and Debentures) Rules, 2014:

1. In Rule 4, in sub-rule (1),

(i) for clause (c), the following clause shall be substituted, namely:-

“(c) the voting power in respect of shares with differential rights of the company shall not exceed seventy four per cent. of total voting power including voting power in respect of equity shares with differential rights issued at any point of time;”;

(ii) clause (d) shall be omitted.2. In the principal rules, in rule 18, for sub-rule (7), the following sub-rule shall be substituted, namely:-

“(7) The company shall comply with the requirements with regard to Debenture Redemption Reserve (DRR) and investment or deposit of sum in respect of debentures maturing during the year ending on the 31st day of March of next year, in accordance with the conditions given below:-

(a) Debenture Redemption Reserve shall be created out of profits of the company available for payment of dividend;

(b) the limits with respect to adequacy of Debenture Redemption Reserve and investment or deposits, as the case may be, shall be as under;-

(i) Debenture Redemption Reserve is not required for debentures issued by All India Financial Institutions regulated by Reserve Bank of India and Banking Companies for both public as well as privately placed debentures;

(ii) For other Financial Institutions within the meaning of clause (72) of section 2 of the Companies Act, 2013, Debenture Redemption Reserve shall be as applicable to Non –Banking Finance Companies registered with Reserve Bank of India.

(iii) For listed companies (other than All India Financial Institutions and Banking Companies as specified in sub-clause (i)), Debenture Redemption Reserve is not required in the following cases-

(A) in case of public issue of debentures –

(B) in case of privately placed debentures, for companies specified in sub-items A and B.

(iv) for unlisted companies, (other than All India Financial Institutions and Banking Companies as specified in sub-clause (i)) –

(A) for NBFCs registered with RBI under section 45-IA of the Reserve Bank of India Act, 1934 and for Housing Finance Companies registered with National Housing Bank, Debenture Redemption Reserve is not required in case of privately placed debentures.

(B) for other unlisted companies, the adequacy of Debenture Redemption Reserve shall be ten percent. of the value of the outstanding debentures;

(v) In case a company is covered in item (A) or item (B) of sub-clause (iii) of clause (b) or item (B) of sub-clause (iv) of clause (b), it shall on or before the 30th day of April in each year, in respect of debentures issued by a company covered in item (A) or item (B) of subclause (iii) of clause (b) or item (B) of sub-clause (iv) of clause (b), invest or deposit, as the case may be, a sum which shall not be less than fifteen per cent., of the amount of its debentures maturing during the year, ending on the 31st day of March of the next year in any one or more methods of investments or deposits as provided in sub-clause (vi):

Provided that the amount remaining invested or deposited, as the case may be, shall not at any time fall below fifteen percent. of the amount of the debentures maturing during the year ending on 31st day of March of that year.

(vi) for the purpose of sub-clause (v), the methods of deposits or investments, as the case may be, are as follows:—

(A) in deposits with any scheduled bank, free from any charge or lien;

(B) in unencumbered securities of the Central Government or any State Government;

(C) in unencumbered securities mentioned in sub-clause (a) to (d) and (ee) of section 20 of the Indian Trusts Act, 1882;(D) in unencumbered bonds issued by any other company which is notified under sub-clause (f) of section 20 of the Indian Trusts Act, 1882:

Provided that the amount invested or deposited as above shall not be used for any purpose other than for redemption of debentures maturing during the year referred above.

(c) in case of partly convertible debentures, Debenture Redemption Reserve shall be created in respect of non-convertible portion of debenture issue in accordance with this sub-rule.

(d) the amount credited to Debenture Redemption Reserve shall not be utilized by the company except for the purpose of redemption of debentures.

“[Enforcement Date: 16th August, 2019]

[Amendment to be incorporated on Pg. 4.44 of SM]

IV. Chapter 7: Management and Administration

Amendments related to - Companies (Amendment) Act, 2019

Following sections of the Companies Act, 2013 have been amended by the Companies (Amendment) Act, 2019 through Notification No. S.O. 2947(E) dated 14th August, 2019 [the sections contained therein shall deemed to have come into force on 15th August, 2019]

In section 90,

(i) after sub-section (4), the following sub-section shall be inserted, namely:-

“(4A) Every company shall take necessary steps to identify an individual who is a significant beneficial owner in relation to the company and require him to comply with the provisions of this section.”;

[Amendment to be incorporated on Pg. 7.13 of SM]

(ii) after sub-section (9), as so substituted, the following sub-section shall be inserted, namely:

“(9A) The Central Government may make rules for the purposes of this section.”

[Amendment to be incorporated on Pg. 7.14 of SM]

(iii) in sub-section (11), after the word, brackets and figure “sub-section (4)”, the words, brackets, figure and letter “or required to take necessary steps under sub-section (4A)” shall be inserted.

[Amendment to be incorporated on Pg. 7.14 of SM]

V. Chapter 9: Accounts of Companies

(A) Amendments related to - Notification G.S.R. 390(E) dated 30th May, 2019

The Central Government has amended the Schedule VII of the Companies Act, 2013.

In the said Schedule VII, after item (xi) and the entries relating thereto, the following item and entries shall be inserted, namely:

“(xii) disaster management, including relief, rehabilitation and reconstruction activities.”

[Enforcement Date: 30th May, 2019]

[Amendment to be incorporated on Pg. 9.38 of SM

(B) Amendments related to - Notification G.S.R. 776(E) dated 11th October, 2019

The Central Government has amended the Schedule VII of the Companies Act, 2013.

In the said Schedule VII, for item (ix) and the entries relating thereto, the following item and entries shall be substituted, namely:

“(ix) Contribution to incubators funded by Central Government or State Government or any agency or Public Sector Undertaking of Central Government or State Government, and contributions to public funded Universities, Indian Institute of Technology (IITs), National Laboratories and Autonomous Bodies (established under the auspices of Indian Council of Agricultural Research (ICAR), Indian Council of Medical Research (ICMR), Council of Scientific and Industrial Research (CSIR), Department of Atomic Energy (DAE), Defence Research and Development Organisation (DRDO), Department of Biotechnology (DBT), Department of Science and Technology (DST), Ministry of Electronics and Information Technology) engaged in conducting research in science, technology, engineering and medicine aimed at promoting Sustainable Development Goals (SDGs).

”[Enforcement Date: 11th October, 2019]

[Amendment to be incorporated on Pg. 9.38 of SM]

(C) Amendments related to - Companies (Amendment) Act, 2019

Following sections of the Companies Act, 2013 have been amended by the Companies (Amendment) Act, 2019 through Notification No. S.O. 2947(E) dated 14th August, 2019 [the sections contained therein shall deemed to have come into force on 15th August, 2019]

In section 132—

(i) after sub-section (1), the following sub-section shall be inserted, namely:—

“(1A) The National Financial Reporting Authority shall perform its functions through such divisions as may be prescribed.”

[Amendment to be incorporated on Pg. 9.16 of SM]

(ii) after sub-section (3), the following sub-sections shall be inserted, namely:—

“(3A) Each division of the National Financial Reporting Authority shall be presided over by the Chairperson or a full-time Member authorised by the Chairperson.

(3B) There shall be an executive body of the National Financial Reporting Authority consisting of the Chairperson and full-time Members of such Authority for efficient discharge of its functions under sub-section (2) [other than clause (a)] and sub-section (4).”;[Amendment to be incorporated on Pg. 9.17 of SM]

(iii) in sub-section (4), in clause (c), for sub-clause (B), the following sub-clause shall be substituted, namely:—

“(B) debarring the member or the firm from—

I. being appointed as an auditor or internal auditor or undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate; or

II. performing any valuation as provided under section 247,

for a minimum period of six months or such higher period not exceeding ten years as may be determined by the National Financial Reporting Authority.”.[Amendment to be incorporated on Pg. 9.18 of SM]

(D) Amendments related to - Notification G.S.R. 636(E) 5th September, 2019

In the National Financial Reporting Authority Rules, 2018, after clause (c) of sub -rule (1) of rule 3, the following explanation shall be inserted, namely:-

“Explanation.- For the purpose of this clause, “banking company” includes ‘corresponding new bank’ as defined in clause (d) of section 2 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 (5 of 1970) and clause (b) of section 2 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980 (40 of 1980) and ‘subsidiary bank’ as defined in clause (k) of section 2 of the State Bank of India (Subsidiary Bank) Act, 1959 (38 of 1959).”.

[Enforcement Date: 5th September, 2019]

[Amendment to be incorporated on Pg. 9.19 of SM]

(E) Amendments related to - Notification G.S.R. 803 (E) dated 22nd October, 2019 w.e.f. 1st December , 2019

The Central Government has amended the Companies (Accounts) Rules, 2014, by the Companies (Accounts) Amendment Rules, 2019.

In the Companies (Accounts) Rules, 2014, in rule 8, in sub-rule (5), after clause (iii), the following clause shall be inserted namely:—

“(iiia) a statement regarding opinion of the Board with regard to integrity, expertise and experience (including the proficiency) of the independent directors appointed during the year”.

Explanation.—For the purposes of this clause, the expression “proficiency” means the proficiency of the independent director as ascertained from the online proficiency self- assessment test conducted by the institute notified under sub-section (1) of section 150.

[Amendment to be incorporated on Pg. 9.26 of SM]

Amendments related to - Notification G.S.R. 313(E).—dated 26th May, 2020

The Central Government has amended the Schedule VII of the Companies Act, 2013.

In Schedule VII, item (viii), after the words “Prime Minister’s National Relief Fund”, the words “or Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES Fund)” shall be inserted.

[Enforcement Date: 28th March, 2020]

[Amendment to be incorporated on Pg. 9.38 of SM]

[I] THE INDIAN CONTRACT ACT, 1872

Amendment via the Jammu and Kashmir Reorganisation Act, 2019, dated 9th August, 2019. The amendment is effective with effect from 31st October, 2019.

As per the Jammu and Kashmir Reorganisation Act, 2019, in the Indian Contract Act, 1872, in sub-section (2) of section 1, words, "except the State of Jammu and Kashmir" shall be omitted.

Now, Section 1 will be read as under,‘

Short title- This Act may be called the Indian Contract Act, 1872.

Extent, Commencement- It extends to the whole of India and it shall come into force on the first day of September, 1872.

Saving- Nothing herein contained shall affect the provisions of any Statute, Act or Regulation not hereby expressly repealed, nor any usage or custom of trade, nor any incident of any contract, not inconsistent with the provisions of this Act.’

[II] THE GENERAL CLAUSES ACT, 1897

Amendment via the Jammu and Kashmir Reorganisation Act, 2019, dated 9th August, 2019. The amendment is effective with effect from 31st October, 2019.

As per the Jammu and Kashmir Reorganisation Act, 2019, the General Clauses Act, 1897 has been extended as a whole.

The Paper 2 of CA Intermediate - Corporate and Other Laws comes for 100 marks in the exam. This paper is divided into two sections called Division A and Division B. Division A comes for 30 marks, and Division B comes for 70 marks.

Below, we have mentioned the chapter wise marks distribution. This way students will know how much attention to be given to each chapter and prepare accordingly.

| CHAPTER NUMBER |

CHAPTER NAME | MARKS DISTRIBUTION |

| PART I: COMPANY LAW | ||

| 1 | Preliminary | 10 |

| 2 | Incorporation of Company and Matters Incidental Thereto | 6 |

| 3 | Prospectus and Allotment of Securities | 12 |

| 4 | Share Capital and Debentures | 2 |

| 5 | Acceptance of Deposits by Companies | 6 |

| 6 | Registration of Charges | 10 |

| 7 | Management and Administration | 8 |

| 8 | Declaration and Payment of Dividend | 6 |

| 9 | Accounts of Companies | 5 |

| 10 | Audit and Auditors | 9 |

| PART II: OTHER LAWS | ||

| 1 | The Indian Contract Act,1872 | 10 |

| 2 | The Negotiable Instruments Act, 1881 | 10 |

| 3 | The General Clauses Act | 7 |

| 4 | Interpretation of statutes | 8 |

| Exam Mode |

Offline |

||||

| Question Type | Objective + Subjective | ||||

| Weightage | Objective | 30 Marks | |||

| Subjective | 70 Marks | ||||

| Total Marks Allotted | 100 Marks | ||||

| Marks Division |

Company Law | 60 Marks |

|||

| Other Laws | 40 Marks | ||||

| Theoretical and Practical Weightage | Theoretical | Practical | |||

| Company Law | 40% - 50% | 45% - 60% | |||

| Other Laws | 35% - 55% | 45% - 65% | |||

| Time Allowed | 3 Hours | ||||

| Medium | English/Hindi | ||||

| No. of Questions Given | Division A | 30 Marks MCQ of 1-2 Marks each | |||

| Division B | 30 Marks MCQ of 1-2 Marks each | ||||

Question 1 Question 2 Question 3 Question 4 Question 5 | 19 Marks 17 Marks 17 Marks 17 Marks 17 Marks | ||||

| No. of Questions to be Attempted | Division A | All Questions are Compulsory from this Division | |||

| Division B | Attempt any 3 questions out of the remaining 4 questions | ||||

Once you have prepared your Study Schedule, it’s time to follow it. Now, how to follow it? It’s simple - by studying. And how to study Law? Well, that’s exactly what we’re going to discuss in this section.

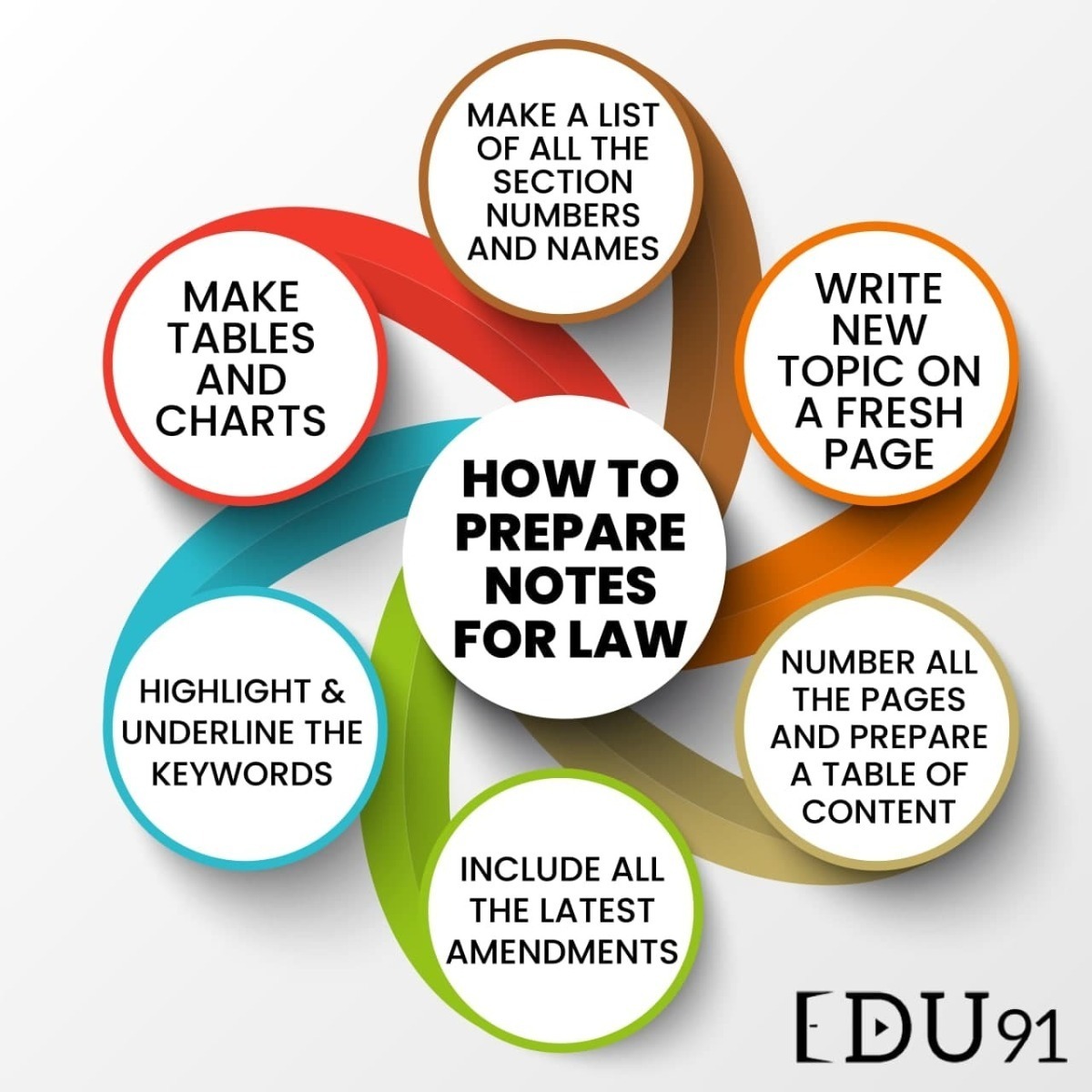

There are two things to be kept in mind if you want to score good marks in exams especially for a subject like Law. The first thing is your preparation before the exam and the second is your presentation during the exam. Here, we are going to talk about how to prepare in order to score good marks in the Law exam.

There are two types of students, one who do self study and the ones who take classes. Their approach of studies is different from each other but there are few things which are common for both of them.

The students who do self study have two extra steps to follow as compared to the students who take coaching classes. The first thing is they need to do plain reading. If you are doing self studies, just open the Institute of Chartered Accountants of India’s Study Material and start reading irrespective of whether you are understanding anything or not.

Read the chapters

Read the chapters out loud. This has Audio-visual benefits. The combination of sound and visual helps you to understand things better.

Conceptual clarity

The second thing the students need to do is get conceptual clarity. Since they don't have any guidance to look forward to, they need to analyze what they are reading by breaking the sentence into different parts.

Break the sentence

For example, suppose you are reading about ‘bailment’. ‘Bailment is delivery of goods from one person to another for some purpose.’ Here, you need to break the definition into several parts, such as ‘bailment’ is -

Analyze the meaning

Now, try to analyze the meaning of each term. Learn the types of delivery, like actual, symbolic and constructive. Then consider what do we mean by goods. Likewise, do it for all the definitions and understand all the components of a word.